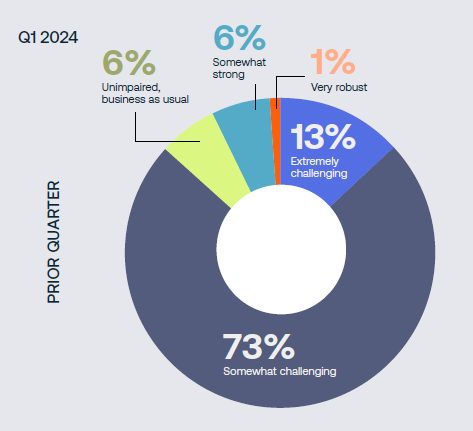

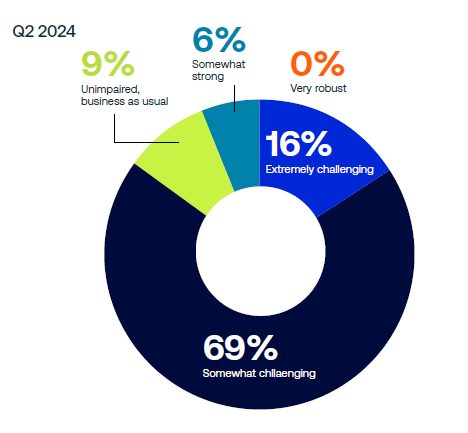

Altus Group has shared the results of their Q2 2024 Commercial Real Estate (CRE) Industry Conditions & Sentiment Survey. This survey, conducted from March 25 to April 29, 2024, gathered opinions from 227 participants across 49 different firms, covering a range of roles within the industry.

The survey reveals some key trends. One of the main findings is a shift towards reducing risk. About 10% of respondents are focusing on selling off assets, which is slightly higher than in the previous quarter. At the same time, fewer people are looking to invest new capital, with only 20% prioritizing it, down from 25% in Q1 2024. Despite this, over one-third of respondents expect revenue and net operating income (NOI) to grow, indicating some optimism. Expectations for spending on capital and cap rates are also stabilizing, suggesting a more balanced outlook.

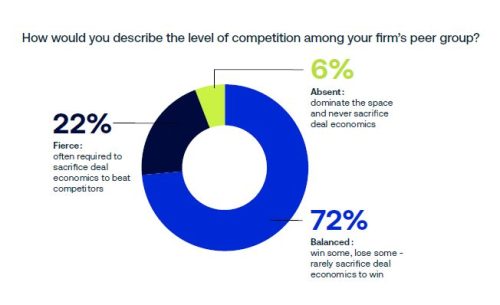

Competition in the market remains steady, with 72% of participants describing it as balanced, meaning they win some deals and lose others. The industrial and multifamily property sectors are seen as fairly priced, while the hospitality and retail sectors have shown significant changes in perceived value. Debt financing costs have generally decreased, with the hospitality sector seeing the largest drops. However, retail sector debt costs have remained relatively stable.

There are growing concerns about a potential economic recession, with 70% of respondents expecting a recession soon. Many think this recession will be shallow but last a long time. Despite these worries, the expectation for transaction activity remains high, especially among larger firms. Bigger companies show more interest in buying and selling compared to smaller firms, indicating different strategies based on company size.

When it comes to priority issues, the cost of capital is the top concern, followed by insurance and operating costs. Geopolitical risks and economic growth are also high on the list of concerns, highlighting the complex challenges the industry faces. Additionally, skepticism about artificial intelligence (AI) is decreasing, especially among experienced professionals, showing a growing acceptance of AI’s potential benefits in the CRE industry.

Overall, Altus Group’s Q2 2024 survey paints a picture of a cautious yet strategic industry, focusing on managing risk and capital while navigating economic uncertainties. For more detailed insights, contact an SVN Advisor today!