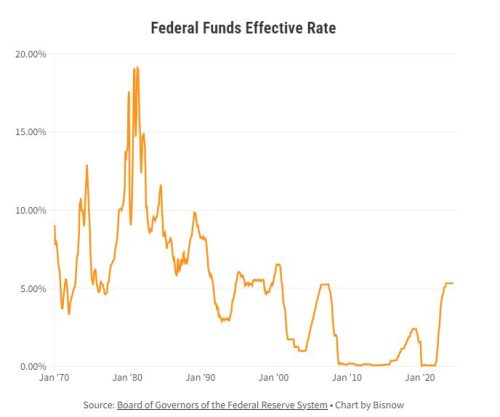

The commercial real estate (CRE) sector has faced a series of challenges that have left it reeling. The onset of the coronavirus pandemic brought empty office chairs and shuttered businesses, creating a landscape of uncertainty. Just as the industry began to stabilize, aggressive rate hikes delivered a second blow, pushing many into a defensive stance. Now, as the Federal Reserve is expected to cut rates, the industry is cautiously optimistic that relief may finally be on the horizon.

A Battered Sector

The pandemic marked a significant downturn for CRE, with office visits plummeting by 82% in the second quarter of 2020 and retail foot traffic falling by 45%. Following swift rate cuts to stabilize the economy, the landscape shifted dramatically. However, a series of consecutive rate hikes over the past year has left many in the industry struggling to adapt to a higher-for-longer capital environment.

Economists like Derek Tang from LHMeyer emphasize that while the anticipated rate cuts won’t wipe the slate clean, they could provide much-needed relief. This moment may mark the turning point CRE needs to rekindle investor interest and unlock new transaction activity.

The Anticipated Rate Cuts

The Federal Reserve’s upcoming meeting is crucial for CRE stakeholders, with expectations of an imminent rate cut that could reshape investor sentiment. Chair Jerome Powell has emphasized the need for policy adjustments to balance employment and price stability. An initial rate cut might signal that the worst is over, boosting investor confidence. Bob Habeeb, CEO of Maverick Hotels and Restaurants, suggests this could be the perfect time for new deals as lending conditions improve.

The Market’s Psychological Shift

While the actual impact of initial cuts may be modest, the psychological effect on lenders and borrowers can be profound. The prospect of lower rates can boost market sentiment and drive investment decisions. Liz Holland, CEO of Abbell Associates, highlights that knowing the worst may be over can encourage hesitant investors to re-engage with the market.

Peter Merrigan of Taurus Investment Holdings reports that even the anticipation of rate cuts has already shifted sales and financing terms for multifamily assets, reflecting a growing optimism among investors.

The New Reality

As CRE adjusts to this evolving landscape, it’s essential to recognize that we are not returning to the pre-pandemic normal. The industry must grapple with fundamental changes in how we work, shop, and interact with commercial spaces. Economic indicators suggest that while the overall economy remains strong, the potential for recession looms, creating a complex environment for real estate valuation.

Ryan Shear, managing partner of Property Markets Group, encapsulates this sentiment by emphasizing that there’s a new reality to which the industry must adapt. Investments will likely concentrate on top-tier developers and properties with a proven track record.

Looking Ahead

As the Federal Reserve begins monetary easing, funds seeking distressed assets may enter the market, with apartment projects likely to benefit first from falling rates. However, borrowing costs are not expected to return to the near-zero levels of the past.

In conclusion, while challenges persist for the commercial real estate sector, anticipated rate cuts offer hope for renewed investor confidence and new opportunities. The coming months will be crucial as stakeholders adapt to the new normal and seek growth in a transformed economic landscape.