Significant Growth in Space Demand

The retail real estate market continues to demonstrate robust growth, with demand for retail space rising sharply even as availability remains constrained. This trend reflects a dynamic sector where retailers remain committed to expansion despite broader concerns about store closures.

In the second quarter, the demand for retail space surged by nearly 13 million square feet, marking an impressive 80% increase compared to the 7 million square feet absorbed in the first quarter. This growth highlights the ongoing strength of the retail sector, as it represents the 14th consecutive quarter in which retail tenants have occupied more space than they vacated. This trend underscores a persistent appetite for retail space amid a historically low availability rate of just 4.5%.

Factors Influencing Demand

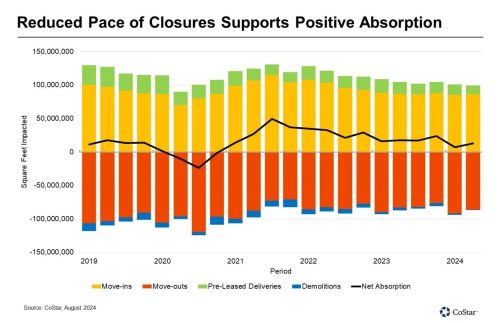

The net increase in demand for retail space is primarily driven by the balance between move-ins and move-outs. While the delivery of new pre-leased spaces and the demolition of existing properties contribute to the overall dynamics, their impact is relatively minor compared to the direct balance of tenant relocations.

In the second quarter, retail move-ins totaled 86.3 million square feet, reflecting a slight increase from the previous quarter. This number is consistent with the totals observed over the past five quarters but is slower compared to the extraordinary levels seen in 2021 and early 2022. During that period, ultra-low interest rates and a significant spike in consumer spending led to a surge in demand. As vacancies have tightened, the pace of move-ins has naturally slowed. Fortunately for retail property owners, the volume of space vacated by tenants also decreased in the second quarter. With move-outs averaging over 100 million square feet per quarter from 2016 through 2020, the recent average of 83 million square feet per quarter since early 2021 reflects a more stable market. In the second quarter alone, 86 million square feet were vacated, leaving the retail space market in a state of equilibrium.

Impact of New and Demolished Spaces

The substantial 13 million-square-foot increase in demand during the quarter was largely driven by new pre-leased retail spaces reaching completion. Specifically, the addition of 13.6 million square feet of new stores and shopping centers created a positive demand environment. This influx of new space was slightly offset by the removal of 500,000 square feet of previously occupied retail space due to demolition.

Outlook for the Remainder of the Year

Looking forward, the U.S. retail market is expected to maintain a positive trajectory for the rest of the year. While the pace of move-outs may increase slightly due to recently announced store closures, the strong and ongoing demand from retailers looking to expand is anticipated to counterbalance the rise in vacant space. Retailers’ continued expansion efforts and the gradual completion of new projects are likely to sustain the current market momentum.

In summary, despite the tight supply and emerging store closures, the retail sector shows resilience and growth, driven by a sustained demand for space and ongoing tenant expansion.