In the ever-evolving landscape of commercial real estate, the full-service hotel sector presents a fascinating study in contrasts. As developers and investors keep a keen eye on market trends, it’s clear that pipeline activity for full-service hotels varies significantly across major markets. Understanding these trends, particularly in relation to the age of existing hotel inventory, can offer valuable insights for strategic decision-making.

A Tale of Two Ages: The Hotel Inventory Landscape

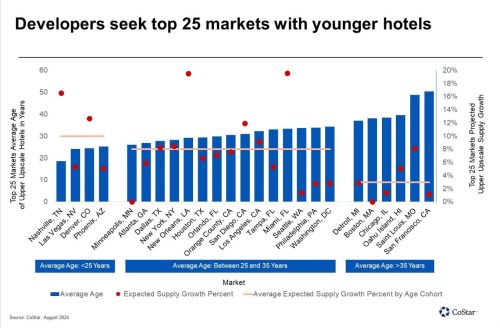

Across the top 25 U.S. markets, the average age of upper-upscale hotel rooms stands at 32 years. However, this average masks a wide range of ages: from a youthful 19 years in Nashville, Tennessee, to a venerable 50 years in San Francisco. In fact, 15 of these markets feature full-service hotel inventory that averages between 25 and 35 years old.

This variance in the age of hotel inventory has a notable impact on pipeline activity. Generally, markets with newer properties tend to show a higher level of development activity. This trend suggests that younger markets are currently more attractive for new hotel projects.

Why Age and Activity Matter

Several factors contribute to this relationship. In markets with limited new supply—like San Francisco, Boston, and Seattle—high construction costs and space constraints in downtown areas can deter new developments. These markets often have older hotel inventories and face fewer new projects due to these logistical and financial barriers.

On the other hand, markets with relatively younger inventories, such as Nashville, Las Vegas, Denver, and Phoenix, have experienced significant demand growth in recent years. Developers are eager to capitalize on this robust performance, buoyed by more available land and favorable conditions for construction.

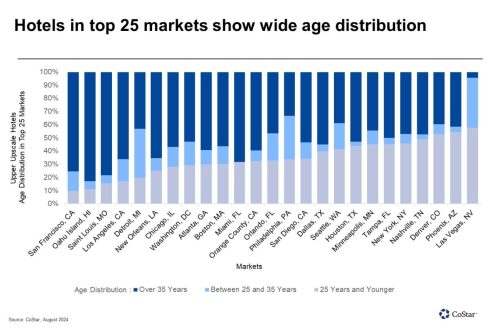

Among the top 25 markets, a significant 15 feature more than 50% of their hotel inventory that is 35 years old or older. This indicates that a substantial portion of the hotel stock in these markets is relatively aged, reflecting a long history and established presence in the hospitality sector. On the other hand, only three markets—Las Vegas, Phoenix, and Denver—stand out with more than 50% of their hotel inventory being less than 25 years old. This suggests that these markets have seen more recent development and have a higher proportion of newer, more modern hotel properties compared to their peers.

Looking Forward: Strategic Insights

For investors and developers, understanding these dynamics is crucial. In markets with aging hotel inventories, focusing on property renovations and updates can provide a competitive edge. Meanwhile, in younger, high-growth markets, staying ahead of the curve with new developments can capitalize on the burgeoning demand.

In summary, the relationship between the age of hotel inventory and pipeline activity underscores the importance of market-specific strategies. By staying informed on these trends, stakeholders can make more informed decisions and navigate the complexities of the full-service hotel sector with greater confidence.

Stay tuned to our blog for ongoing insights and updates on commercial real estate trends, helping you stay ahead in this dynamic market.